The gap in the appetite for new computing technology between enterprises and hyperscalers and cloud builders is widening, but no one is talking about causality quite yet even though there is probably some link between the rise of clouds and more conservative spending on the part of enterprises.

But there is, perhaps, another cause. It could just be that the growth in traditional computing in the enterprise that is dedicated to things like print, file, web, email, and database serving is now less than the Moore’s Law increases that are enabled by process shrinks at the fabs run by Intel. This is precisely what has happened to mainframe platforms, proprietary midrange platforms, and Unix platforms, so why would the same thing not happen to standalone X86 servers used by small and medium businesses to run their application software as well as large enterprise customers who are running larger applications – and more of them – on clusters of X86 iron. Enterprises might also just be getting better at squeezing more efficiency from their iron, as cloud builders and hyperscalers are doing. Maybe even with the same techniques.

These thoughts are on our minds as we contemplate Intel’s financial figures for the third quarter, which by a lot of measures was a stellar one with sales of chips aimed at consumer and commercial PCs as well as devices aimed at the datacenter both showed good growth. But even as PCs showed more growth than perhaps many had expected, sales in the Data Center Group that is what The Next Platform is most interested in analyzing slowed yet again and now the goal of a sustained 15 percent annual growth rate is most certainly not being attained.

In the quarter ended on October 1, revenues were up 9.1 percent to $15.78 billion. With expenses held reasonably flat and $372 million in restructuring charges relating to the 12,000 layoffs that were announced back in April (about 11 percent of its workforce, which will cost around $2 billion in total), the rise in revenues were nonetheless able to boost net income at the company by 8.7 percent to $3.38 billion in the period. Intel had $5.8 billion in cash flow and was able to pay out $1.2 billion in dividends and buy back $457 million in its own stock, the latter of which helped boost its earnings per share metrics. Intel had just over $8 billion in cash and investments as the quarter came to a close, its cash hoard significantly reduced by the $16.7 billion deal to acquire FPGA maker Altera that was finalized earlier this year.

In the Data Center Group, which makes chips, chipsets, and motherboards for servers as well as processors for networking and storage devices, platform sales (meaning processors, chipsets, and motherboards) accounted for $4.16 billion, up 8 percent, and other products (such as software and interconnects) accounted for $378 million, up 33.4 percent. Add these up, and Data Center Group had $4.54 billion in overall sales, up 9.7 percent. But here is the caution. Operating income for Data Center Group was off just a tad under one percent, to $2.11 billion.

This chart makes it clear that Data Center Group in Intel’s second quarter did not grow along the normal pattern, essentially matching, at a macro level at least, what it did in the second quarter. It is still a very large and profitable business – in fact, we think Data Center Group has the largest pool of profits in the datacenter, as anything that can sustain between 45 percent and 50 percent operating margins must surely be.

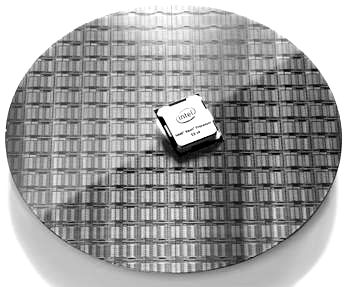

As we pointed out a few weeks ago in discussing the server at peak X86, Intel is having trouble growing profits and revenues at the same time not only because of technical issues relating to the ramp of 14 nanometer processes used to make the “Broadwell” Xeon E5 v4 processors as well as the ramp of its Omni-Path networking chips and server adapter cards, but because of more intense pricing pressure from its largest cloud and hyperscale customers, who are looking for alternatives, and enterprise customers, who are consuming a little less capacity than Intel can deliver for reasons that no one has explained to our satisfaction.

Brian Krzanich, Intel’s chief executive officer, said on a conference call with Wall Street analysts that the cloud service provider segment of its Data Center Group business was up 32 percent year-on-year. (These customers are building systems for public cloud builders and hyperscalers, as the lingo here at The Next Platform goes.) The communications service provider segment (which means telecommunications companies that are modernizing their networks with generic gear as well as building cloud capacity for their own applications) saw a 16 percent growth in the third quarter, which is still quite good. And adjacent products not relating to Xeon chips and chipsets, including the Omni-Path and silicon photonics networking and Xeon Phi parallel processors, grew by 34 percent. But the interesting bit is that none of this was enough to make up for the fact that the server makers who sell gear to plain vanilla enterprises of all sizes pulled 3 percent less revenues than Intel had a year ago, and this enterprise segment is still apparently more than half of Intel’s Data Center Group revenues. Two years ago, Intel had been expecting for its enterprise business to resume growth, and then it was supposed to be flat, and now it is shrinking. We think there are a few forces at work here, but first and foremost, we think that some companies are shifting a portion of their workloads to the cloud, whether they use IaaS, PaaS, or SaaS services. We also think that many of their workloads are not growing as fast as Intel can deliver capacity with each successive generation of Xeon processors. This is not what is happening at hyperscalers and cloud builders, of course. They want as many cores as Intel can cram in a footprint at a given price and thermal envelope.

Given this, Intel now expects for Data Center Group to have revenue growth in the high single digits for all of 2016, about a third lower than it had been planning for a few years back, and expects for enterprise spending to continue to be down in the fourth quarter, too. And the 14 nanometer ramp for Broadwell Xeons, and now we presume for “Skylake” Xeon E5 v5 processors due in 2017, is still cutting into profits. This is somewhat unusual, given that the first Broadwell Xeons started coming off the line and shipping to early hyperscale and cloud customers approximately a year ago and the 14 nanometer processes were used on PC chips before then. Intel is not yet ready to make forecasts for 2017 in terms of demand for the current Broadwell Xeons or the future Skylake Xeons.

The actual datacenter business at Intel is considerably larger, of course, than the revenues it books in the Data Center Group. The company sells Lustre and other systems software as well as flash drives that end up inside servers and storage arrays, and thanks to its acquisition of Altera, that business also contributes to its revenue and profit stream out of the datacenter. We think Intel does not add these parts of its revenues to Data Center Group because these units are nowhere near as profitable as the core Xeon chip business. But we like to look at the “real” datacenter business at Intel to keep it straight in our heads, and do some estimating on how these other parts of Intel have sales into the glass house. (It is more like a warehouse these days, but that is an old term of art.) In our model, half of revenue of the Internet of Things Group and 90 percent of the revenues from the Non Volatile Memory Solutions Group are earmarked for the datacenter, and all of the FPGA sales in its Programmable Solutions Group are. We think this is a reasonable proxy. Take a look:

If you do the slicing and dicing and adding that way, then the “real” datacenter business at Intel grew 17.4 percent in the third quarter to around $5.9 billion, but if you then add in losses from investments in 3D NAND and 3D XPoint memory as well as the inherently lower profits in the other groups that sell at least some wares into the datacenter, then operating profits fell by 3.9 percent to $2.16 billion. This operating profit level is still much larger than Intel overall, but it is less than the level that the Data Center Group as reported turns in, which hit 46.5 percent of revenues.

Wall Street and IT managers have been wondering what the ramp is looking like for 3D XPoint and what affect, if any, the knowledge that Skylake Xeons and their 3D XPoint setups for servers are having on sales now for Broadwell Xeon platforms.

Krzanich said that Intel is shipping samples of 3D XPoint memory to customers now, and in the current Q4 would ship “thousands of samples” to customers, with Intel finishing qualifications at the end of this year and then ramping shipments into 2017. The original plan was for 3D XPoint SSDs early in 2017 and for 3D XPoint server DIMMs later in the year – we are not sure if this has changed, but there has been some scuttlebutt about this.

As for Skylake somehow causing the slowdown in Broadwell sales in the enterprise sector – or any other part of Intel’s Data Center Group business – Krzanich poured cold water on that idea, saying that high-end hyperscaler and cloud customers have not decreased their spending on Broadwell iron and you would expect them to do that first if there was going to be a Skylake pause. This makes a certain amount of sense, especially with Intel already sampling Skylake Xeons on their “Purley” platforms to selected “leading edge customers.” (This is usually the hyperscale and HPC crowds.)

“They are seeing not only just an overall TCO performance advantage that we typically see with each one of these,” Krzanich explained, “but this also continues our integration of things like the Omni-Path fabric, it has more integration of the silicon photonics. So it is still the adjacency functions that are quite strong, and they will get more and better as we go through each one of these. There will be a second generation of Purley that includes 3D XPoint. It allows pooling of memory and then there will be future ones that will allow additional pooling of things like FPGAs. So, each one of these now add some additional features across the rack that really helps in the overall system performance.”

We were under the distinct impression last year that the first generation of the Skylake Purley platforms would include 3D XPoint. Hmmm.