If Mellanox Technologies had not begun investing in the Ethernet switching as it came out of the Great Recession, it would be a much different company than it is today. It might have even been long since acquired by Oracle or some other company, for instance.

To be sure, Mellanox might have been able to capture some business at the cloud builders, hyperscalers, and clustered storage makers with InfiniBand. But it would not have been the one to capitalize on moving InfiniBand-style technologies such as remote direct memory access (RDMA) to Ethernet, and it would not have been able to offer complete networking hardware stacks – including network interface cards, cables, and switches – to these important companies that represent the leading edge of IT and that help stimulate research and development even if the business they bring is not particularly profitable. The leading edge is often not profitable – traditional HPC has always been skinny on the margins, and hyperscalers and cloud builders demand similar discount levels because of the volume of business they do.

The point is, the rest of the industry benefits from the investments that are made by these key customers into such IT vendors. The profit pools that make companies sustainable in the long run accumulate in normal enterprise datacenters, which do not operate the scale of an HPC center, a hyperscaler, or a cloud builder. The technology trickles down, and the amount of revenue and profit flow increases as the water goes from a steep stream hopping over boulders in the mountains to a slower, meandering river in fertile valleys.

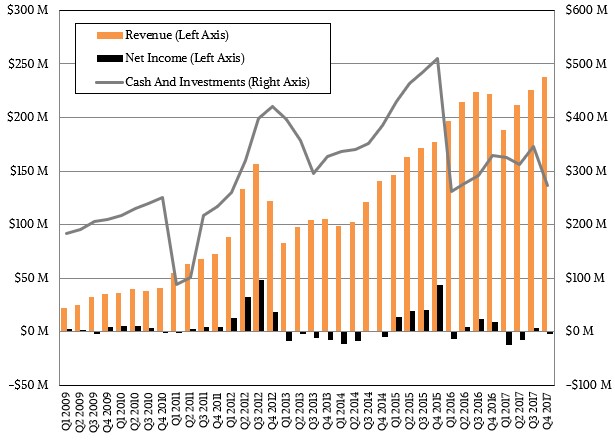

The trick is to get into the valleys, and Mellanox, after doing a lot of investment, is paring down a bit and focusing to get the kinds of profits in the coming years that its substantial investment warrants. It doesn’t hurt that Starboard Value, an activist investor based in New York, bought a 10.7 percent stake in Mellanox back in November and has been pressuring management at Mellanox to cut operating expenses and goose profits.

This is precisely what Mellanox was already in the process of doing, having decided to shutter the standalone network processor line, called NPS, last summer to focus on its “BlueField” hybrid smart NIC business.

Then, in early January, Mellanox decided to shutter one of the silicon photonics research efforts that Mellanox has been engaging in since the acquisition of IPtronics for $47.5 million and Kotura for $82 million back in the summer of 2013. IPtronics makes vertical cavity surface-emitting laser (VCSEL) drivers, modulator drivers (MDs), and transimpedance amplifier arrays (TIAs). Kotura was selling variable optical attenuators and optical multiplexers when Mellanox bought it, but was ramping up to ship 4x25Gb/sec circuits for QSFP cables used to build out 100 Gb/sec datacenter fabrics. Mellanox is not shutting down its silicon photonics efforts, by the way, but rather focusing on the 1310 nanometer wavelength products for single mode fiber that hyperscalers are interested in and not on the 1510 nanometer products for multimode fiber. (Multimode fiber is way more expensive, and hyperscalers want to push single mode. Mellanox could not have known that five years ago; even the hyperscalers didn’t know that yet.)

The discontinuing of the NPS line had no effect on the financials, but around 100 people will be laid off as the 1550 nanometer photonics effort is shut down, and Mellanox will book a charge of between $21 million and $24 million to cover the cost off the layoffs and the writing down of the assets associated with this business. In the fourth quarter of 2017, Mellanox took a $12 million charge to cover about half those costs.

That would have had a much more dramatic downward affect on profits during the quarter had it not also been for some favorable tax credits, to the tune of $5.4 million, that helped. In the quarter, sales were up 7.7 percent to $237.6 million, and had it not been for the restructuring and assuming Mellanox could have taken the same tax benefits, it might have seen net income grow by something on the order of 5 percent to around $9.5 million. But that didn’t happen, but Wall Street seems to understand that the changes that Mellanox made and the short term costs will help lower overall costs over the longer term. Specifically, shuttering the one silicon photonics effort will cut between $26 million to $28 million. So once all of the charges are off the books in Q2 2018, Mellanox will be inherently more profitable, all other things being equal.

Mellanox paid down $126 million in debt during the quarter, and is eager to pay down the remaining $74 million on its books, which was costing it $1.9 million in interest payments. If Mellanox did that today, it would still have $200 million in the bank, which is a pretty good cushion for a company that will be kissing $1 billion in sales as 2018 comes to a close, if all goes well.

The Two Horse Team Of InfiniBand And Ethernet

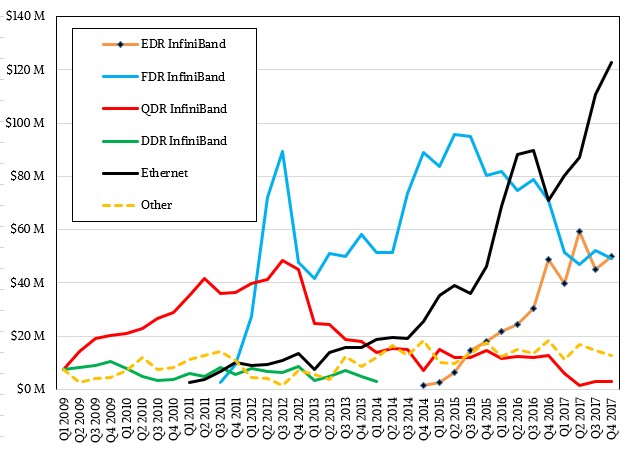

The dynamics of the Mellanox business are a very good indicator of what is going on in the various sectors of the high performance computing market, generally speaking, which includes traditional HPC with its simulation and modeling, and the scale-out workloads of hyperscalers and cloud builders; the latter often includes raw infrastructure, analytics, disaggregated storage, and machine learning, all of which have very specific – and differing – network needs.

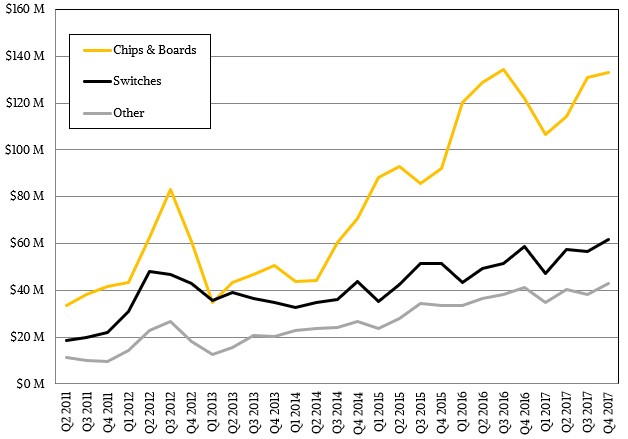

For the second quarter in a row, the combined sales of Ethernet products – switches, cables, and NICs – at Mellanox have surpassed those of InfiniBand. In the third quarter, InfiniBand sales were $100.2 million, while Ethernet revenues came to $110.7 million. And in the fourth quarter, the gap widened further, with InfiniBand garnering $102 million in revenues compared to Ethernet bringing in $122.8 million.

Eyal Waldman, the chief executive officer at Mellanox, told Wall Street analysts last week in a call going over the numbers that the company expected for its Ethernet switch revenues to double, and LinkX cables are also growing like crazy at hyperscalers and could grow by 50 percent in 2018; Mellanox already has the lion’s share of server adapter cards with its ConnectX line, and is beating out Intel, Broadcom, and Cavium in this hotly contested area, not just because of good technology but because its adapter cards can work with either InfiniBand or Ethernet and because they provide offload capabilities that free up CPU cores and, in the case of the BlueField products, adjunct processing that can be used to do some of the work performed by CPUs right in the network stream.

With 200 Gb/sec Spectrum-2 chips ramping in 2018, and 200 Gb/sec HDR InfiniBand under the Quantum brand also ramping in the second half of this year, Mellanox is looking forward to a big upgrade cycle among hyperscalers, cloud builders, and HPC shops. It will be interesting to see if HPC centers stay with InfiniBand, which offers much lower latency and even more offload of functions from the CPU to the switch ASIC, or go with more generic Ethernet. For latency sensitive work, InfiniBand still holds a more than four to one advantage (call it 90 nanoseconds versus around 400 nanoseconds) on a port-to-port hop. How this plays out for applications, it all depends.

At the moment, you would think that most customers would be buying 100 Gb/sec EDR InfiniBand chips or switches, but Mellanox still sells a lot of gear to clustered storage makers and database cluster builders, who have certified their platforms on slower 56 Gb/sec FDR InfiniBand and have not yet moved up to EDR. That’s why you see them neck-and-neck in terms of revenues. If InfiniBand was not so useful for storage or database clusters, it would be a much smaller business focused only on HPC clusters. And Mellanox would not be the force in high performance networking that it is. That said, Waldman does not expect for InfiniBand to grow much in 2018, and told Wall Street to expect for InfiniBand sales to be flat to slightly up. That is just the nature of this market right now.

Looking ahead, Mellanox expects for revenues in the first quarter of 2018 to be between $222 million and $232 million, which is somewhere between 17.7 percent and 23 percent revenue growth and which is a pretty big jump for Mellanox. For the full year, the company expects for sales to fall somewhere between $970 million and $990 million, which is somewhere between 12.3 percent and 14.6 percent growth year-on-year. You can bet that someone will want to close that extra $10 million deal to hit $1 billion.

How are you seeing QLogic Ethernet roadmap. How they can sustain in front of Mellanox !!