The general consensus, for as long as anyone can remember, is that there is an insatiable appetite for compute in the datacenter. Were it not for the constraints of budgets, for both the acquisition of iron, the facilities to house it, the electricity to power and cool it, and the people to manage it, it is safe to say that the installed base of servers worldwide would be much larger than it is.

But the world doesn’t work that way, and there are constraints. But thanks to ever more complex applications, ever richer media, and a burning desire to save all data and try to mine something useful out of it, the server market is booming after languishing a bit in the wake of the Great Depression a decade ago. How long this will last is anyone’s guess, and whether or not anyone aside from Intel is actually generating profits from this steady and heady growth in 2017 is still a matter of some concern. That said, we will take the good news where we find it.

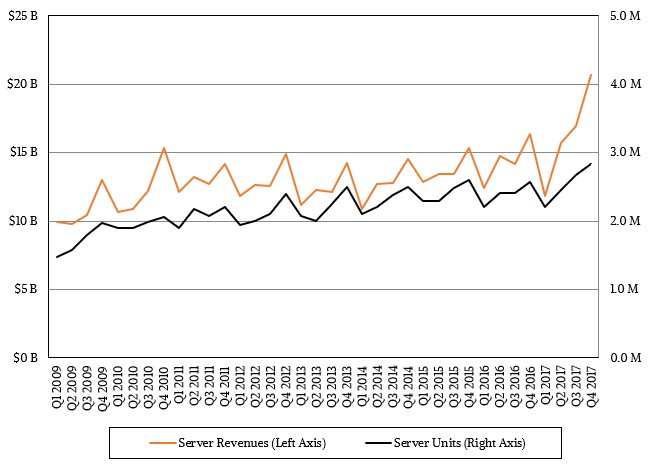

Datacenters certainly came to the fourth quarter of last year hungry, and according to the latest statistics from IDC, they consumed 2.84 million units of iron, a 10.8 percent increase over the prior year’s final quarter. Thanks to IBM’s big bump up with System z14 mainframe sales and to a general trend of buying beefier boxes for hefty machine learning, analytics, and HPC workloads (admittedly but a slice of the server shipment pie), revenues for those servers shipped rose by 26.4 percent to $20.65 billion. This is the first time ever that server sales broke through the $20 billion barrier, and after IDC finishes restating its ODM server revenues for the first quarter of 2017, it is likely that it will report revised sales for all of 2017 to kiss $67 billion. Over that same period, Intel’s Data Center Group will account for $19.1 billion in sales and $8.4 billion in operating profit, just to give you a sense of the chip giant’s slice of the pie. If you are generous and assume that there is a 10 percent operating margin on servers – and that is because big iron NUMA machines and mainframes bring up the class average bigtime even as the ODMs do maybe 5 points of profit at best – that is a potential operating profit for the server industry of around $7 billion. If that is close to reality, then Intel will have around 27 percent of server revenues passed back to it by its OEM and ODM partners as a cost for compoents. If you add Intel’s profit to the server industry’s aggregate profit, and then add in the profit for memory and flash makers, Intel could account for 40 percent of the profit and as much as 50 percent back when memory and flash cost half as much as it did a year ago.

This is what we have been talking about when we say that server sales are booming and everyone is benefitting at the top line but the profit is not being spread around proportionally. This makes for an unhealthy ecosystem, but perhaps not an unusual one.

In the quarter, sales of volume servers – meaning machines that cost less than $25,000 – rose by 21.9 percent to $15.8 billion, more or less in lockstep with the market, and in fact, dragging down the numbers a little bit. Sales of midrange servers, which in the IDC definition cost somewhere between $25,000 and $250,000, jumped by a whopping 48.5 percent to $1.9 billion. This rise is no doubt being caused in part by the use of much richer configurations of CPU-only machines as well as the rise of nodes used in HPC and AI clusters that are stuffed to the slots with GPU accelerators. In the high end of the market, which is dominated by IBM mainframes and a handful of RISC/Unix suppliers such as IBM, Oracle, and Fujitsu and which is comprised of big NUMA iron that costs in excess of $250,000, revenues jumped by 41.1 percent to $2.9 billion in the fourth quarter.

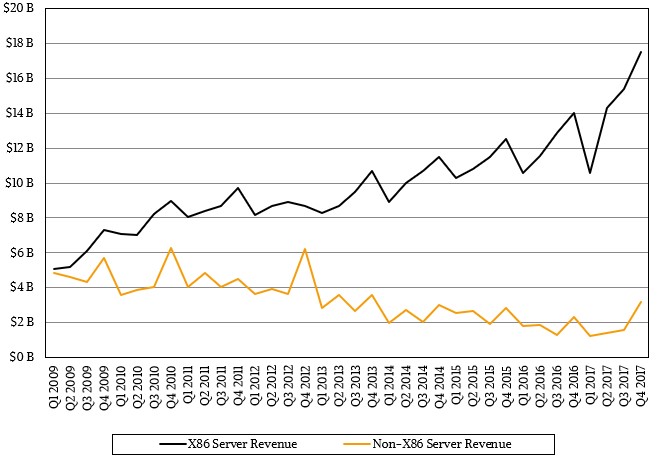

If you want to look at it by processor architecture, X86 iron drove $17.5 billion in revenues, up 24.7 percent and representing 84.7 percent of total worldwide server revenues, according to IDC’s box counters. In terms of shipments, X86 iron accounted for 2.82 million machines, up 11.4 percent and representing 99.3 percent of the server pie. Without any competition, Intel could probably get to 95 percent revenue share and 99.5 percent shipment share, but starting late last year Intel started getting competition, and we will see it play out in the coming quarter. AMD Epyc servers and Qualcomm and Marvell (thanks to Cavium) Arm servers will start getting traction, and Ampere (formerly known as Applied Micro) will start getting some deals, too. All it takes is for a few hyperscalers to switch and there goes a ton of market share.

That left $3.15 billion for the non-X86 camp in the fourth quarter, an increase of 36.4 percent compared to a year ago and driven largely by pent up demand for System z14 mainframes. IBM should see another bump this year as the Power9 servers roll out, first in the Power AC922 CPU-GPU hybrid system, then in regular scale-out clusters aimed at Xeon and Epyc iron, and then later in high-end NUMA iron. According to the Power9 launch schedule, as we understand it from people familiar with IBM’s plans, Big Blue should have all of the Power9 iron in the field by the third quarter of 2018. All of the compares are easy here, since the Power8 and Power8+ were at the tail end of an elongated four-year cycle.

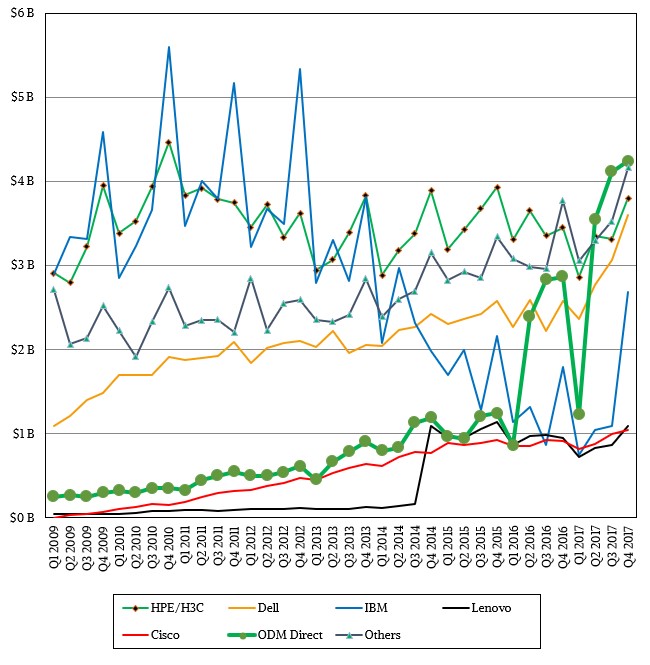

The usual suspects dominated the server space in the fourth quarter, and everybody seemed to benefit from the boom. Hewlett Packard Enterprise, thanks to its H3C partnership in China, maintained its revenue share lead, with $3.8 billion in sales, up 10.1 percent. Dell followed fast on its heels, though, with $3.61 billion in sales, rising 39.9 percent and significantly outpacing the market. IBM turned in the best quarter it has had in a long, long time, with $2.7 billion in revenues, up 50.3 percent and giving it the fuel and the hope to stay in the system space.

Growth at Lenovo and Cisco Systems was below the class average, but better than what HPE was able to do, and reflective of the markets and geographies where these two companies play. Both are comfortably in the zone of $4 billion in sales per year, which is about what a contender can do with HPE, Dell, and the ODM collective hogging a lot of the volumes. Lenovo managed to rake in $1.09 billion in sales, according to IDC, up 15.1 percent year on year, with Cisco pulling in $1.05 billion, up 14.8 percent. The ODMs accounted for $4.25 billion in sales, up 48.1 percent, and all of the remaining players who sell to end users (which is what IDC tracks) brought in $4.16 billion, up 9.9 percent.

By the way, the ODMs had a 62.8 percent rise in shipments, to 653,000 units in the quarter, according to IDC. Dell was the top shipper, with 582,500 machines pushed out the factory door, a 9.6 percent increase. The combined HPE/H3C actually saw shipments declining by 7.9 percent to 479,700 units, so clearly HPE is selling heftier boxes to get its revenue growth. Unless something radical happens with the Power Systems line, IBM will never be among the top shippers again. But Lenovo, by virtue of buying IBM’s System x server business three years ago is the number three shipper, even though it only pushed 181,600 machines in Q4. That was a 17 percent drop. Lenovo is in a four-way tie for the number three shipper position because the gaps are not huge relative to the market size. Huawei Technologies pushed 166,400 units of tin (down 7.1 percent) Supermicro did 158,500 units (up 28.1 percent), and Inspur sold 154,100 units (up 35.7 percent). All other vendors accounted for 465,100 machines, off 2.2 percent compared to the year ago period.

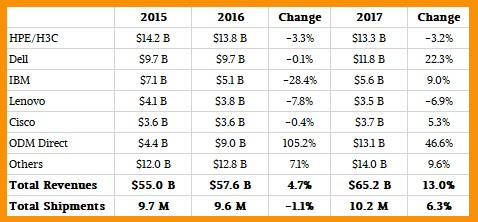

Given the volatility in the server space the days, due mostly to the scheduling of upgrades among hyperscalers and cloud builders, it is perhaps best to look at vendor market share on an annual basis, not quarterly. Here is how the money stacked up:

The interesting bit as far as we are concerned is that the ODMs – Quanta Computer, Foxconn, Inventec, Jabil Circuit, Tyan, WiWynn, Hyve, and a few others –had about the same revenue share as HPE/H3C in 2017, and if conditions persist, the ODMs, as a group, will be the top shippers in 2018. It will be time to break them out individually and start talking about the top OEMs and the top ODMs.

The question we have is this: will this boom that took off in the fourth quarter of 2017 last? A lot depends on the global economy. If there is a recession – and there is no indication that one is due except that it has been about a decade, which is the normal rhythm – then all bets are off, except that there will be big changes. But if the economy holds and enterprises start investing a little more and the hyperscalers and cloud builders continue their expansion, then there is a possibility that we could be seeing somewhere around $75 billion in 2018 with 15 percent growth and maybe $85 billion in server revenues in 2019 with 10 percent growth.

For us old server dawgs, who remember a server market that had $57.5 billion in sales against 3.92 million machines in 1999, which was a boom year indeed, this is a very different market. If you ignore all the history in between those two decades (which is laughable) that’s only a 20 percent expansion in revenues against a 2.6X increase in unit shipments. That right there is the power of Moore’s Law. By the way, IDC’s forecasts from 1999 were projecting for sales to hit $65 billion that year, which they did not because the dot-com boom went bust, and went all the way out to 2003 with forecasts of $88 billion in sales, and $37 billion of that was going to be RISC/Unix iron, if you can believe it. None of that happened, and the market collapsed when everyone realized that having a website backed by a Unix database server and a sock puppet for marketing was not going to transform business all by its lonesome. Clearly, the hyperscalers and cloud builders got it right, and many enterprises did, too, with distributed computing in its many forms taking advantage of those Moore’s Law improvements to store and chew more data.

It is very surprising to see IBM third in the vendor list without selling any x86 boxes. Can anyone provide more details on that?

You make a great point and thanks for the article. As you allude, servers are becoming specialized, e.g. dense compute (big data, etc) and storage servers (SDS). It is the underlying trends that are the drivers of this growth. The adoption of SDS is the likely driver of increased revenue at the ODM’s since it has a higher price/unit and SDS is high growth. 46% growth, that’s impressive!

The stock price of WiWynn is up to 400 TWD from 200 TWD in the last month with strong earnings from Q1. I expect it to go up over 1000 TWD with strong cloud computing growth and strong demand for servers from datacenters.

I just ordered a Dell PowerEdge 710, I’m a home user and have never used an Intel machine since the Celeron days.