Both Hewlett-Packard and Compaq, which also included parallel database system maker Tandem and minicomputer innovator Digital Equipment Corp when HP bought Compaq for $25 billion back in September 2001, had histories as platform providers but the combined companies were not able to create on the X86 platform the kinds of venerable platforms such as the HP 3000 and DEC VAX and AlphaServer minicomputers, the HP 9000 Unix systems, or the Tandem NonStop systems.

But, with the combination of its GreenLake cloud-like hardware and systems software sales model and its Ezmeral mashup of the Kubernetes container controller and the MapR file system, HPE has created a new platform – one that supports various kinds processing, storage, and networking elements – that it completely controls and therefore from which it benefits economically in a way that it has not seen since the 1980s and 1990s.

To be fair, GreenLake is still fairly modest in terms of customer count as well as the number of unique services it provides in addition to hardware and software available under the subscription pricing model, but the number of platform elements and unique services running atop GreenLake is growing every day.

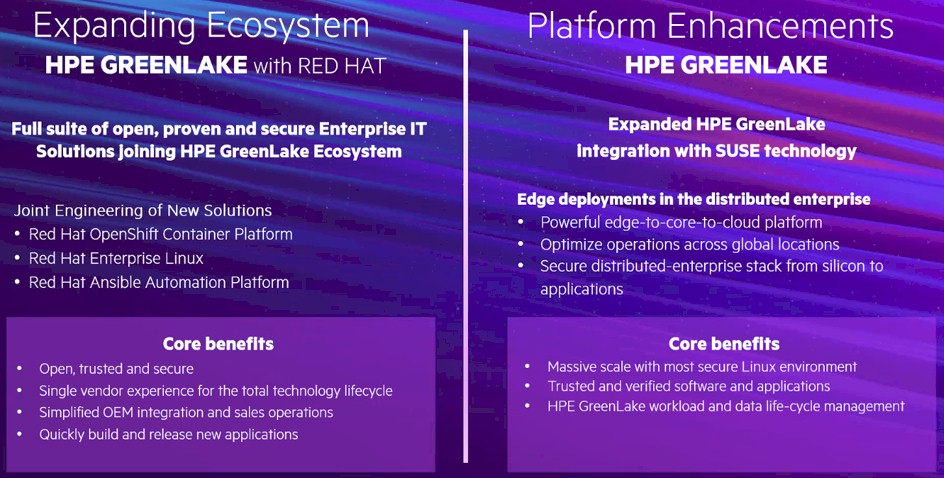

At the annual HPE Discover customer and partner event this week, both Red Hat and SUSE Linux, who have been long-time partners with Compaq and then HP since the early days of commercial Linux subscriptions, are tightening their ties with HPE so they can ride the GreenLake gravy train. And enterprise customers, who are the early adopters of the GreenLake services, want one throat to choke when things go wrong and one check to write when the bill comes in – and in both cases, they want the one to be HPE.

The irony, as far as we are concerned, is that starting in the 2000s, both HPE and Dell got a case of IBM envy really bad, and did lots of acquisitions to create conglomerates with servers, storage, switching, software, and services – the five Ss of the enterprise datacenter. This did not pan out as planned for either HPE or Dell, and even IBM’s ability to wring profits out of this massive conglomerate waned. And thus all three of them started divesting their non-core businesses, including software and services. Today, what HPE seems to be rebuilding is not so much the IBM of the 2000s, but the Big Blue of the 1960s and the 1970s, where it has a complete, vertically integrated platform that it sold on a rental basis to its customers and that it had to be compelled by antitrust lawsuits to provide at a fair price for sale. (It’s weird how history winds itself up and then unwinds itself again. . . . )

The subscription model has been around longer than the name GreenLake at HPE, and when it formally launched two years ago, it had 850 customers and over $4 billion in aggregate contract value across them. This time last year, GreenLake had 1,200 customers and $4.8 billion in total contract value, and as Discover 2022 is happening, HPE has around 1,600 GreenLake customers with $7.1 billion in aggregate value. This is by no means a hockey sticking business, but it is growing steadily if somewhat lumpily. We think it will settle out as the idea sinks in that companies can put all of this hardware, software, and services on HPE’s balance sheet and get all of the benefits of onsite control without having to own stuff.

If you just assume the growth rate from June 2021 to June 2022 going forward, GreenLake will have close to 16,000 customers and over $180 billion in total contract value by June 2030. It is hard to say how much revenue this will generate but if the ratio between total contract value and annualized revenue run rate gets slightly bigger over time, then we could be talking about HPE pulling in $18 billion a year in GreenLake subscriptions, in the broadest sense of that utility computing term, and that would be somewhere on the order of two thirds of its revenues – if revenues remain roughly flat. There is always a danger to linear extrapolation from a small dataset far out into the future. We fully realize. The point is, by the end of the decade, it could be weird to actually buy stuff from HPE rather than renting it and HPE could be carrying a ton of stuff on its balance sheet, offset by a guaranteed future revenue stream.

A lot will depend on the expansion of services that HPE offers and customer appetites for paying a slight premium to rent stuff as opposed to buying it. Back in March, HPE added a dozen new services, including block storage and HPC as GreenLake services, and had more than 50 services available through GreenLake. (These services are akin to those that are counted up each year by Amazon Web Services, which has hundreds of services on its cloud.) Only three months later, HPE says it has over 70 services available through GreenLake, and they come in all shapes and sizes:

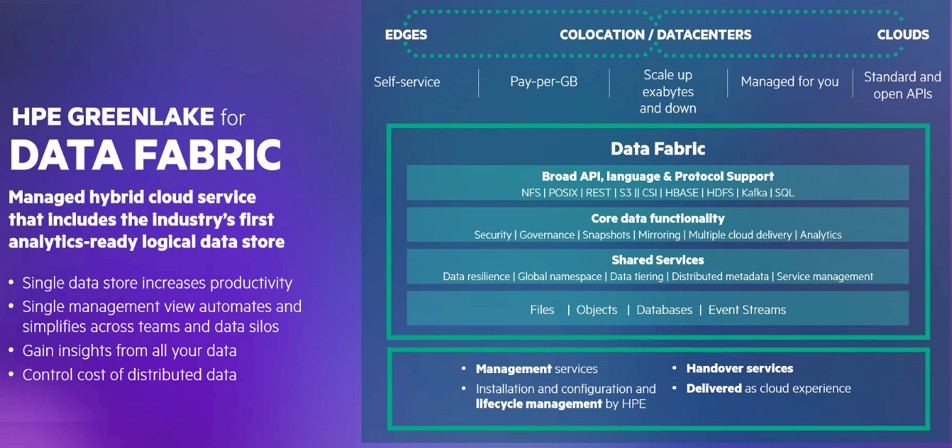

The big services introduced this time around are GreenLake for Private Cloud Enterprise and GreenLake for Data Fabric. (Why is the word “for” necessary in the services name?)

The private cloud allows for HPE infrastructure to be set up for bare metal, virtual machine, or container formats and for that infrastructure to be billed for as it is consumed, just like on a big cloud like AWS, Microsoft Azure, or Google Cloud. And like those clouds, GreenLake is getting an increasing number of “instance” types that are tuned to specific workloads as well as the workloads themselves from third parties, again, all available with a few clicks all from HPE.

The most interesting new service is the GreenLake for Data Fabric, which is the MapR file system that has been renamed under the Ezmeral brand and is now integrated as a single data store for structured and unstructured data underneath GreenLake, sitting alongside block and file services already launched.

In a sense, HPE is working as the system integrator and the financier for GreenLake infrastructure and the sales force for the applications that will run as services atop that infrastructure, and it is one of the few companies that can bankroll such an operation. The stack will have managed services and automation to cut costs for enterprises, and deep integration of components to increase the speed of deployment.

When all is said and done, if GreenLake works as HPE thinks it will, enterprises will be more dependent on a single company than they have probably ever been before. Just like they would be if they moved their workloads to AWS, Microsoft Azure, or Google Cloud. If the experience is smoother than integrating best of breed and financially easier on the customer balance sheets, that is a trade that many enterprises will take given the fact that they do not want to be IT integrators but they do need to wield IT effectively. They want to spin it up, spin it down, and give showback on costs and capacity use, as HPE puts it.

Be the first to comment