In the coming weeks and months, particularly as we are entering the financial reporting season for the first quarter of 2020, we are naturally going to be looking for any good news we can find. We have always contended that recessions accelerate technology transitions while technological innovation, not the economic crisis itself, is the thing that actually causes them. And here we sit, with the major IT players getting ready to tell us how the quarter went and what they think of the future, and it is interesting to contemplate just how much the Great Infection might transform the datacenter – or, not.

For instance, there was a widely reported statement just out of China that Alibaba Group is going to be ponying up 200 billion yuan (about $28 billion) over the next three years to invest in the cloud infrastructure for the group, and it was specifically stated that it would be buying a lot of chips and servers as well as developing its own operating system, Aliyun Linux, and rolling out more datacenters. How the money was going to be allocated is, of course, a trade secret, but trying to figure out if this is actually more spending than the company was already going to invest is the real issue.

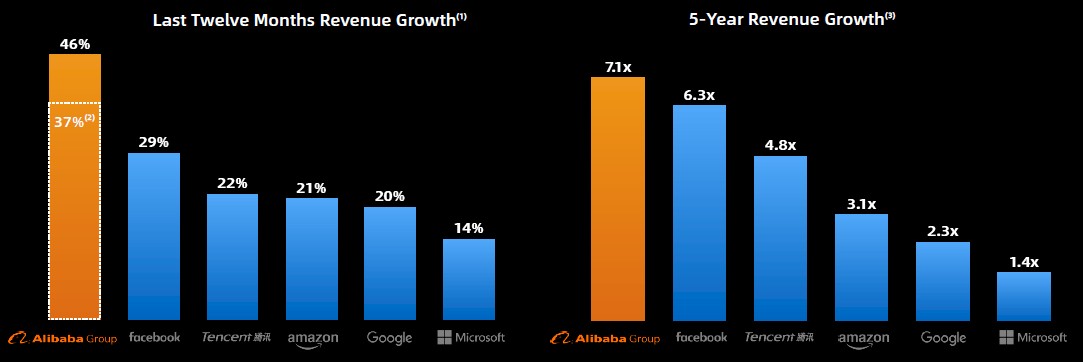

Alibaba Group is an important bellwether, so doing the math on this massive investment matters if we are just not going to try to spread sunshine around for its own sake. The conglomerate owns the Alibaba search engine founded in 1999 and now the Alibaba Cloud public cloud as well as the Taobao online and Taobao Live shopping sites. It is the equivalent of Amazon Web Services plus Google in a country that has 4.2X more people as the United States and 3.6X as many people as the Europe Union once Great Britain exits. That is a big market, and it has big players that, like Alibaba, make massive investments all the time in infrastructure. Alibaba is, however, the fastest growing of the Super 8, although this chart below created by Alibaba for its Investor Day last September drops out Baidu and JD.com from the data for the biggest hyperscalers and cloud builders:

Here is what we know. In fiscal 2018 ended in March of that calendar year, Alibaba spent ¥15.6 billion (that’s the abbreviation for renminbi or yuan or about $2.3 billion when converted to US dollars) on operating capex, which is a proxy of sorts for IT spending. We say a proxy because it includes literal product warehouses used for its vast online retail operation as well as warehouse-scale datacenters, as Google used to call them. This operating capital expense was set against ¥249,566 billion ($37.19 billion), or about 6.2 percent of revenues. Now, in fiscal 2019 ended in March of last year, Alibaba spent ¥32.3 billion ($4.8 billion) operating capex against total revenues of ¥376,844 billion ($56.15 billion), or about 8.5 percent of revenues. That is also a 109 percent (meaning like a 2.1X) growth in operating expense between 2018 and 2019 against a 51 percent revenue growth.

In the first three quarters of fiscal 2020, revenues at Alibaba rose by 15.7 percent to ¥327.44 billion, but operating capital expenses fell by 21.8 percent to ¥20.8 billion. This is not surprising at all because during two of those three quarters all of the hyperscalers and cloud builders were cutting back on capital spending on IT infrastructure; what was surprising is that there was not a larger amount of spending in the December 2019 quarter.

Here’s the thing, then, and the math that you need to do to understand the enormity of the investment that Alibaba is talking about. Assuming that fiscal 2019 was a more typical year than fiscal 2020 will turn out to be – we don’t know what Alibaba spent in the March 2020 quarter yet, but it was weaker in every other quarter of fiscal 2020 than in the quarters of the prior year – then spending $28 billion over three years on IT infrastructure is a pretty big jump for the fiscal years 2021, 2022, and 2023 ending in March of those years. If you assume almost all of that operating capital expense is allocated for IT gear and datacenters and if you further assume operating capital expenses are flat in fiscal 2020 (which seems likely given the impacts of the coronavirus pandemic in China in the final quarter of the fiscal year), that would be about a 40 percent growth in the IT budget from here on out each year to burn through that $28 billion.

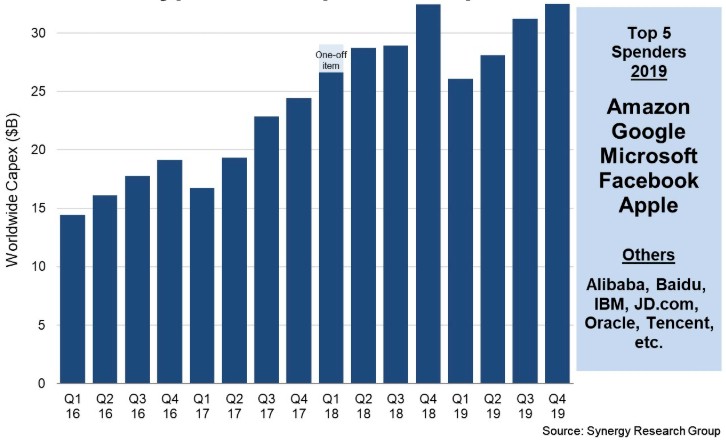

So how does this compare to the hyperscaler and cloud pack overall? It is a pretty big chunk of change, as it turns out. Synergy Research Group tracks the spending of the top twenty of these companies, and in calendar 2019, their capital expense spending was close to $1.4 trillion, up 13 percent over 2018’s levels. The top five spenders, ranked in order, are Amazon, Google, Microsoft, Facebook, and Apple, and Alibaba is ranked among the other fifteen smaller players but unlike many of them, is growing fast. Here is the quarterly capex spending from the hyperscaler/cloud builder peer group from 2016 through 2019, inclusive:

Synergy says that capex spending at these companies was only up 1 percent for the year, but that the datacenter-specific capex was up 11 percent (taking out that other stuff like real warehouses where applicable). Amazon, Microsoft, and Facebook were the big growers in capex spending in 2019, and Apple apparently slashed spending, dragging down the overall class average. (Synergy did not elaborate on how much, or why.) Add them all up, and there are 512 massive datacenters operated worldwide by the top 20 hyperscalers and cloud builders.

“As expected, there was a significant boost in hyperscale operator capex in the second half of 2019, which helped to counter a relatively soft start to the year,” explained John Dinsdale, chief analyst at Synergy in a statement accompanying its latest report. “How will coronavirus impact this trend going forwards? While there are many unknowns, what is clear is that the hyperscale operators generate well over 80 percent of their revenues from cloud, digital services, and online activities. The radical shifts we are seeing in social and business behavior will actually provide some substantive tailwinds for many of these businesses. These hyperscale firms are much better insulated against the current crisis than most others and we expect to see ongoing robust levels of capex.”

Aaron Rakers, the senior analyst at Wells Fargo tracking the IT sector, tore apart the IT and datacenter capex spending from the hyperscalers and cloud builders and reckons that Alibaba spent $3.5 billion in 2017, boosted that by 57 percent to $5.5 billion in 2018, and then cut it by 31 percent to $3.8 billion in 2019. And just to give you a sense of scale, Rakers estimates that Microsoft spent $17.4 billion in 2019, Amazon spent $31.9 billion, Facebook spent $23.5 billion, and Google spent $15.7 billion. You can tell from these numbers who has the Prime service and massive warehouse distribution centers.

A lot of the hyperscalers generate a substantial portion of their revenues from advertising, and heaven only knows what companies plan to do with their advertising spending. (Our guess is it will be stable because spending on events has stopped dead, but that is predicated on the global economy having a fairly fast recovery and the governments of the world spending into the downturn like crazy to keep cash moving through the world system.) If advertising spending takes a dive, this can be compensated with higher fees on social and communication services that are either free or cheap that will become necessary in a quarantined world.

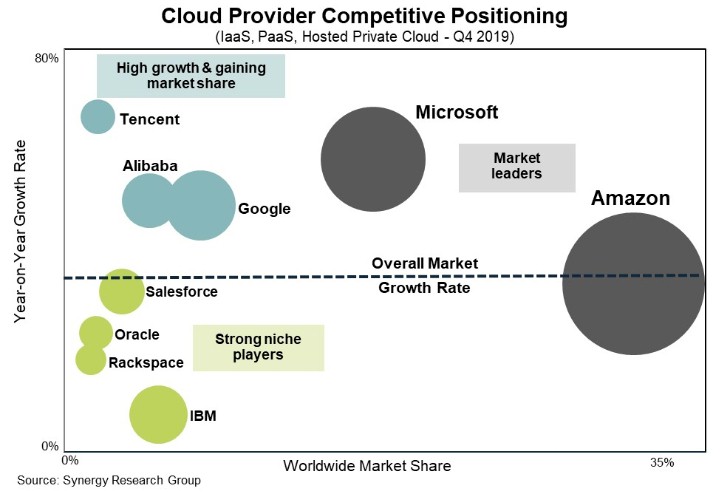

This chart from Synergy kind of sums up the playing field among the cloud providers (who in many cases are also proving services hyperscale-style):

Alibaba may have a competitive search engine (also called Aliyun) to challenge Baidu (which is the Google of China when it comes to search) and a massive online retail operation (which can challenge Tencent and JD.com), but it is a relative newcomer in selling cloud computing capacity. (The wonder is why Facebook and Baidu do not try to cover at least some of their IT costs by building more datacenters and selling excess capacity. The pair are among the few companies in the world that has the capital and smarts to do so, but it may just be a fool’s errand to try to jump in now.)

In the March 2019 quarter, Alibaba’s cloud computing business grew by 76 percent to ¥7.73 billion ($1.15 billion), only about 8 percent of the company’s overall business. In the December 2019, only nine months later, that cloud business was running at ¥10.72 billion ($1.6 billion), and it is likely that it will come close to ¥40 billion ($6 billion) for the year ended in March 2020. But as the chart above shows, Alibaba Cloud is number five behind AWS, Microsoft Azure, Google Cloud, and IBM Cloud – although it should be able to grow past Big Blue in 2020 with relative ease. Tencent is growing fast and probably cannot catch up to Alibaba any time soon for raw IaaS, PaaS, and SaaS services. All told, Dinsdale believes that the cloud providers sold $27 billion in capacity for compute, storage, and networking in the fourth quarter of 2019, with over $96 billion for the full year and growing by close to 40 percent.

Given the size of the Chinese market, the needs to run businesses remotely thanks to the pandemic and its aftereffects, and to necessity to sell goods and services online because people are going to remain closer to home even after this pandemic settles down, Alibaba Group is going to need more iron to drive the revenue opportunity in front of its constituent companies. It will be interesting to see if the other hyperscalers and cloud builders follow suit to the same degree.

All we know for sure is that the odds favor the big getting bigger and therefore the rich getting richer.

Be the first to comment