Nearly a year ago at an analyst day event in New York, Qualcomm, the largest maker of ARM chips aimed at smartphones, told the world that it had aspirations for the big machines that feed those smartphones their data and applications and jumped into the 64-bit ARM server fray.

Today, Qualcomm showed off the first fruits of its ARM server labors, which the company divulged actually began more than two years ago, and that is a prototype chip that is intended for early adopters – presumably hyperscale customers who are always looking for a computing edge. The company also committed to delivering a production-grade ARM server chip as fast as it can without committing to a particular time.

Like other suppliers in the nascent ARM server space, Qualcomm has kept mum about its future server chips and roadmaps. But the revelation of a working pre-production version of an ARM server chip, and that it plans to come out next year with a beefier production chip that it says will compete against other ARM suppliers and the Xeon processors that currently rule the datacenter, is meant to show that Qualcomm is serious about getting into the datacenter. The partnerships that Qualcomm announced with networking chip and switch maker Mellanox Technologies and FPGA maker Xilinx are a significant part of the company’s plans for the data center – and echoing IBM’s own OpenPower Foundation partnerships that started out with Mellanox and Nvidia for networking and accelerated compute and that now include Altera and Xilinx. (With Intel buying Altera, it is reasonable to expect that Xilinx will play a key role with non-Xeon chip suppliers.) Qualcomm did not announce a partnership for GPUs with Nvidia and did not answer questions on that topic, but a partnership could happen in the future.

Given the intense competition between all ARM chip designers and the financial and market might that Intel can bring to bear against any competitor, Qualcomm is understandably hesitant to talk much about its server development platform, which is now sampling to tier one datacenter customers, according to Anand Chandrasekher, general manager of the Datacenter Group at the Qualcomm Technologies division of the chip maker. This division, created in 2012, is where Qualcomm does its open source projects and other developments where it wants to share intellectual property.

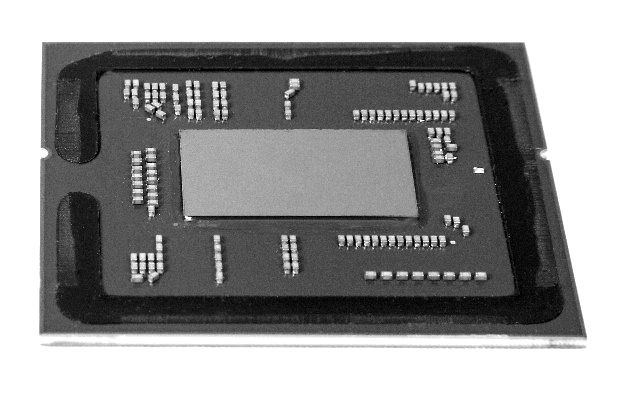

Qualcomm is not disclosing the core design or other attributes of its 64-bit ARM server chip except to say that it hews to the ARMv8-A specification from ARM Holdings and that it has 24 cores. Qualcomm is not revealing what process technology it is using to make the prototype chip or any details on clock speeds, cache memory, main memory, on-chip controllers, and other features, and it is not talking about its code-name, either. What the company is saying is that it will deliver a production-grade ARM server chip using an advanced FinFET 3D transistor process that will have more cores than the pre-production chip showed off today.

Qualcomm did not talk about who its fab partner was for the pre-production ARM server chip or for the production version that is coming out in the future, but Vinay Ravuri, vice president of product management in the Datacenter Group and formerly general manager of server products at Applied Micro, which is trying to ramp its X-Gene 64-bit ARM server chips, says that Qualcomm has historically used Taiwan Semiconductor Manufacturing Corp and Samsung, which have fabs in Taiwan, and Semiconductor Manufacturing International Corp, which runs fabs in China, as partners for its cell phone and other chips. It is reasonable to expect one of these vendors is making the as-yet-unnamed ARM server chips

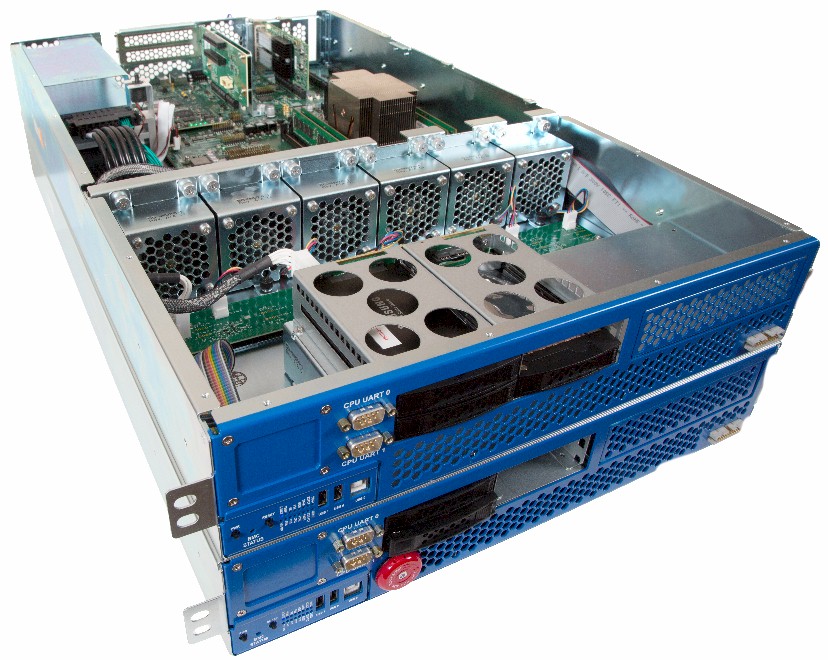

Rather than just trot out a presentation, the Qualcomm Datacenter Group team trotted out a stack of three of its server development platform machines at a meeting in San Francisco. The nodes were shown running a an open source Linux operating system with the 2.4 kernel, all orchestrated by the OpenStack cloud controller and using the KVM hypervisor to load up a standard Linux distribution and run a WordPress content management system fronted by the Apache web server. Ravuri tells The Next Platform that Qualcomm will put bits of code upstream in the Linux kernel to support its ARM server system-on-chip features and the modified ARM cores it has created for the chips, and that eventually the key Linux distributions will be enabled to support the Qualcomm processors.

ARM Holdings licenses designs for ARM cores, interconnects, and other components of a system-on-chip to chip makers who in turn modify them for their own uses. This ability to have code portability while allowing customization is why ARM Holdings has hundreds of licensees for its technology. That enthusiasm for the malleability of chips in the ARM ecosystem, more than anything else, is why Intel is providing custom chips to hyperscale datacenter operators, cloud providers, and certain system makers. It is also why Intel is keen on learning how to make system-on-chip designs that are common in the client and networking areas where many of the ARM server chip makers are coming from.

Like AMD, Applied Micro, Broadcom, and Cavium Networks, Qualcomm is a full licensee of the ARMv8 architecture, and that means it can and does make its own cores rather than use the Cortex-A53, Cortex-A57, and Cortex-A72 cores that ARM develops itself for those who don’t want to make their own cores. (They all have to support the ARMv8 instruction set, of course.) Everyone is probably expecting that this ARM server chip is really just a variant of the Snapdragon 820 processor, with the “Kryo” core design, that was just announced for client devices, but this is apparently not the case.

“The chip we demonstrated today is based on Qualcomm purpose-built cores, they are not a licensed core,” Ravuri confirmed. “This is not based on the Snapdragon 820, these are server custom chips, and even the cores are server-specific cores, and are not mobile cores as the 820s are.” Ravuri cannot say much about the performance of the current prototype Qualcomm ARM server chip or the future one, but did say that “the future Qualcomm chip will be competitive in performance and price with current and future Intel chips.” As for the timing, Ravuri said it would be “sooner rather than later” but that he “can’t say when.”

That would be the current “Haswell” Xeon E5 v3 processors, launched in September 2014, and the future “Broadwell” Xeon E5 v4 processors, widely expected sometime in the spring of 2016. To be competitive with Intel means getting the future, production Qualcomm server chip out the door in 2016. This is when the other ARM suppliers for servers will also be ramping.

At the moment, the prototype ARM server chip from Qualcomm is limited to a single socket, and for many workloads, particularly at hyperscalers, that is fine so long as that socket has enough oomph and memory. But Ravuri conceded to The Next Platform that Qualcomm and its early adopter customers foresee the need for symmetric multiprocessing (SMP) clustering of processors together for certain workloads using ARM chips. Thus far, the ThunderX chip from Cavium Networks is the only ARM supplier with two-way SMP. The point is, SMP is definitely on the Qualcomm roadmap, although precisely when it might appear is unknown.

Designing a chip is one thing, but what makes Qualcomm think it can deliver the server goods? Ravuri explains:

“To really succeed, you need to have staying power, and that is one of the advantages that Qualcomm has. The second thing is, we have the ability to invest in leading edge nodes. Intel is very powerful because of its fabs, as everybody knows. So to compete, you have to be on a leading edge node, and being a mobile company, Qualcomm does have those assets and that will help a lot. Customers have been waiting, and one of the reasons why ARM has not really taken off is that buyers want a company that is viable and that they can count on being here for the next five to ten years for several generations of products.”

Ravuri says that Qualcomm is working with the top eight hyperscalers in some form or another – that’s Amazon, Facebook, Google, and Microsoft in the United States and Alibaba, Baidu, China Mobile, and Tencent in China – but did not confirm who is actually getting test kit and who might have made any commitments to actually use ARM servers in production. He added that Qualcomm is working with original design manufacturers (ODMs), who make machines on behalf of these hyperscalers and service providers, and original equipment manufacturers (OEMs) like the dominant server makers in the world. Dell, Hewlett-Packard, and Lenovo probably have the most interest in ARM chips among the server OEMs, but again, Qualcomm is not naming names.

It is curious what kind of acceleration is implemented on the Xilinx FPGA? Is it a FPGA-based Ethernet/IB NIC?

They did not say. The hint was a standalone FPGA with a more integrated solution in the future–much as Intel is doing with Altera.